Blog

6 more charts you need to see from the World Press Trends Report

On Thursday’s we published a selection of 6 charts not to miss from the WAN-IFRA World Press Trends Report. With the rich amount of thought-provoking content in the report, we thought it would be the perfect opportunity to uncover 6 more insightful charts as a bonus.

Read our most recent article about WAN-IFRA’s World Press Trends Report 2023-2024.

1. Digital reader revenue is where the future money is

Although print still dominates in terms of revenue generation, it is on a declining trend. Last year, print circulation revenue was down by 13% to $54 billion. The pandemic has truly accelerated the shift away from the world of print and towards the digital world. With this shift, digital reader revenue has become even more important for publishers. Last year, digital reader revenue was up 23% to $6.9 billion.

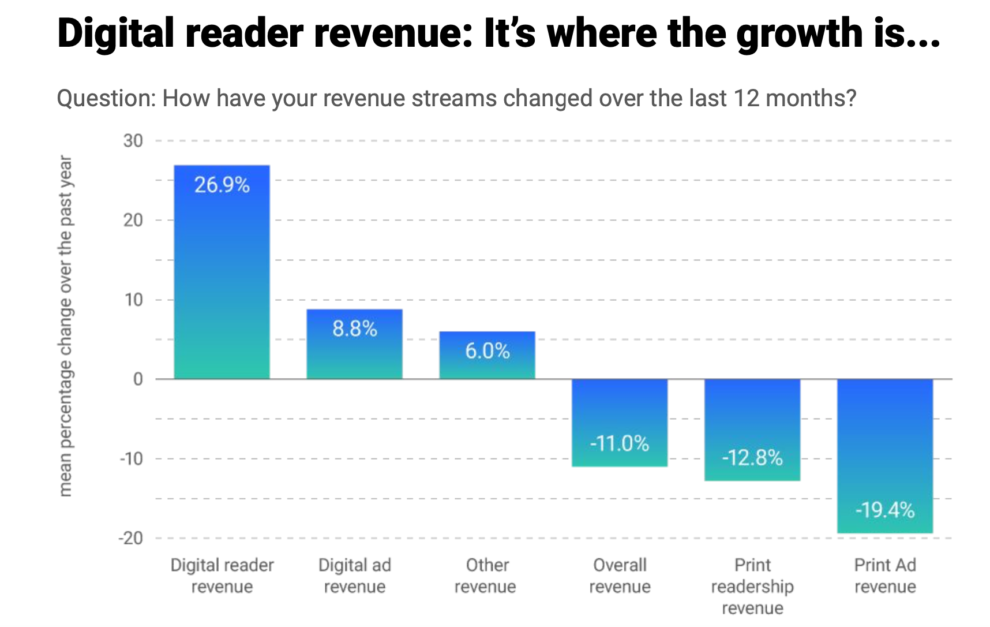

WAN-IFRA found that publishers saw a 26.9% increase of digital reader revenue in their revenue streams. This figure signifies a sizeable increase, especially when compared to a downturn of 12.8% for print readership revenue. Clearly, readers are shifting to digital platforms. Edition technology like Twipe’s NextGen and Replica can help publishers turn the transition of print readers to digital into an opportunity for growth.

2. Accelerating digital transformation is publisher’s top priority for 2021

With the societal side effects of the pandemic still unknown and the huge increase of digital subscribers from the pandemic, digital transformation is a natural area for publishers to focus on.

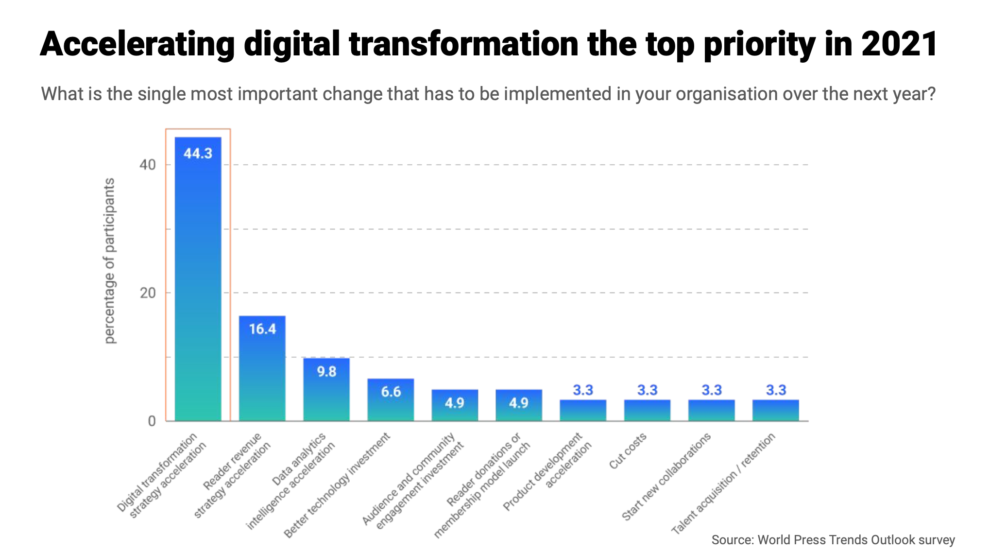

An impressive 44.3% of publishers identified digital transformation strategy acceleration as their top priority for 2021. This is a positive trend for the industry as it represents a leap into a new era. The time for publishing to catch up with the digital world is now.

3. Reader revenue is at the top of publisher’s 2021 budgets

To be able to undertake this desired digital transformation, publishers need to invest in their digital technologies. The top investment priorities for publishers therefore come as no surprise. The highest priority for publisher investment is paid for digital content, which is closely followed by technology and data for reader revenue strategies.

Digital subscribers provide a sustainable revenue stream. They also provide one that, if done properly, will continue to grow in the coming years. They have the potential to make up a proportion of declining print readerships, thus investment here is crucial. This long-term investment will help publishers to increase their digital reader revenue and prepare for the digital future.

4. Innovation drives higher revenue increases

In an increasing trend, publishers clearly see innovation as being vital for the success of their organisations. Over the past years there has been a growing number of digital innovation projects and initiatives.

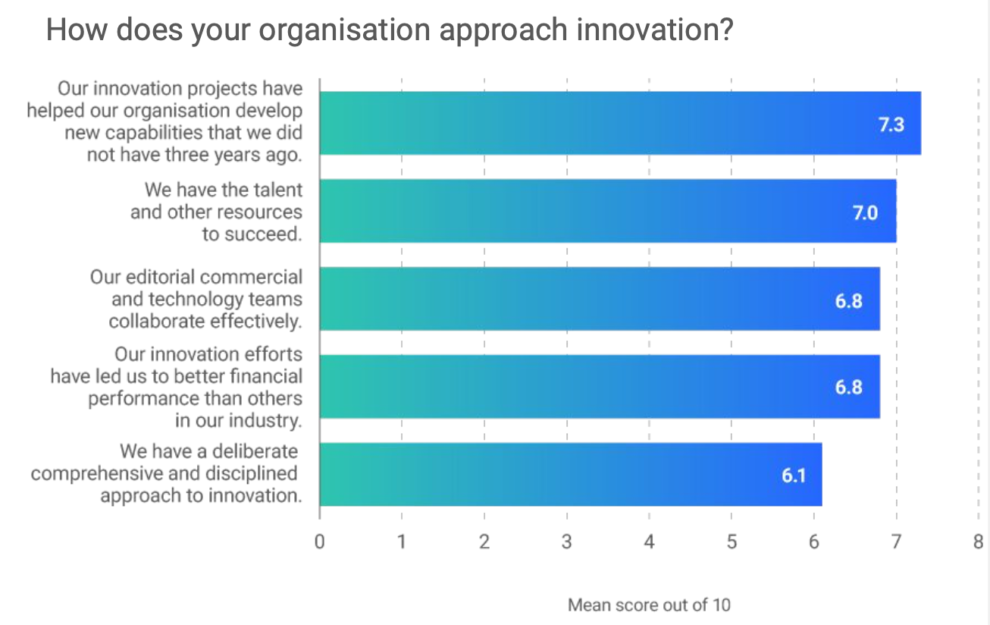

In a positive outcome from WAN-IFRA’s report, publishers across the board show a healthy attitude to innovation. The highest scoring approach saw publishers state that their innovation projects have helped their organisation develop new capabilities that they didn’t have 3 years ago. This perhaps explains the success of some publishers in the pandemic that were digitally advanced enough to weather the storm and grow their subscriber base. Other promising takeaways from the chart show good levels of collaboration between editorial and technology teams, and better financial performance than competitors. This is an encouraging takeaway for the future of publishers.

5. The triopoly takes 65% of the advertising market and 90% growth

It has long been said that advertising revenue is in decline. With the ending of third party cookies on the horizon, digital ads face even greater difficulty. This has been a key reason as to why we have seen publishers investing in digital and exploring other revenue streams. To this end, publishers have also been strengthening the first-party data collection so that they can continue to successfully engage their loyal subscribing audience.

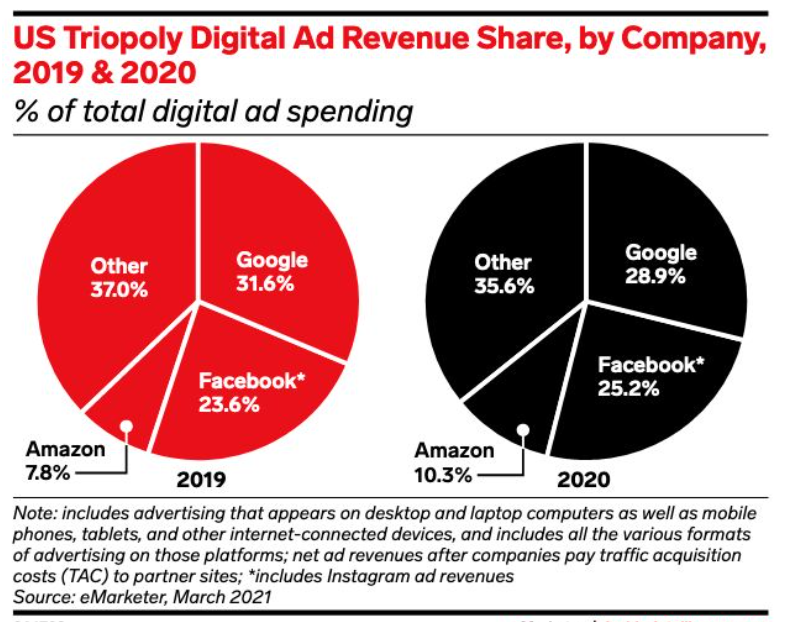

This focus on other revenue streams is particularly important when looking at the state of the digital advertising revenue market share. The US Triopoly, Amazon, Facebook and Google, take up just under 65% of the digital advertising market. On top of this, they benefit from nearly 90% of all growth in the market, leaving newspapers and other fighting for the leftovers. There is a shrinking ad spend globally for newspapers with digital newspapers making up solely 1.9% of global ad spend and their print counterparts making up 3.8%. It will certainly be key to follow the future of digital ads.

6. Advertising’s highest chance of survival still lies with newspapers

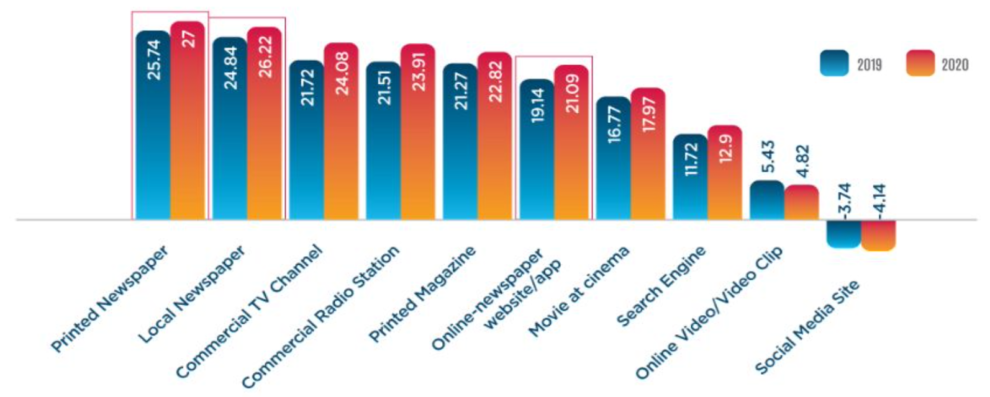

Despite this decline, there is some hope for advertising. Newspaper reader value their newspaper’s ability to provide them reliable and factual information unlike on other platforms. This is also the case with advertising.

Consumers still consider traditional news media as the most trusted media to consume advertising. This customer trust in newspapers is why advertisings’ highest chance of survival lies with them. In the graphic above, it is clear that trust in social media adverts is portrayed as extremely unreliable and untrustworthy. Despite the slow decline of the advertising market, their beacon of hope comes in the form of putting their trust in publishers.

Other Blog Posts

Stay on top of the game

Subscribe to Twipe’s weekly newsletter to receive industry insights, case studies, and event invitations.

"(Required)" indicates required fields