Blog

8 charts that you need to see from Reuters Predictions for 2023

Reuters Institute for the Study of Journalism have released their latest set of predictions for 2023 which shine a light on some of the biggest trends to monitor in 2023. From a survey of 303 news executives from across the world, we have selected 8 graphs for you need to see.

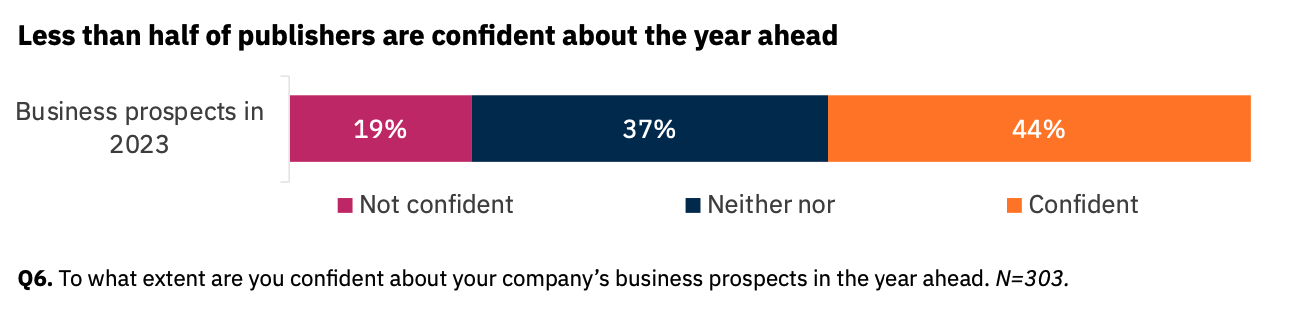

1. Confidence levels have dropped to 44% since 2022

At a time of turbulence, confidence in the prospects for business growth have dropped. Just 44% told Reuters that they are confident for 2023. This is a worrying drop compared to the 75% who were confident about the prospects of their business in 2022.

In the face of financial disruption, this confidence crisis comes as no surprise. Cuts and layoffs have been widely reported. This trend didn’t miss digital-born outlets like Morning Brew, who are set to let go of 14% of their workforce. As publishers are faced with harsher circumstances, more difficult decisions are expected in 2023.

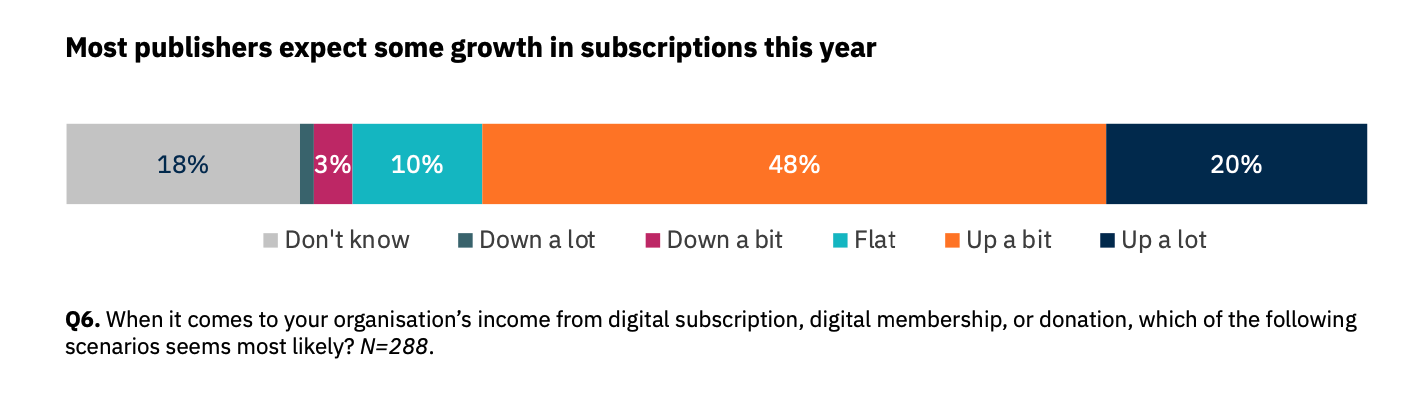

2. 68% expect continued subscription growth

Subscriptions remain the modus operandi for publishers. 68% still expect growth in subscriptions, despite the well documented economic challenges.

Central to this subscription growth, according to Reuters, will be bundling. The New York Times have provided the ‘best in class’ approach. In Q3, we saw that the majority of their growth came from bundle subscribers who were able to gain additional access to non-news apps like NYT Cooking along with access to The Athletic. CEO Meredith Kopit Levien explained that these bundle subscribers pay more over time and are also less likely to cancel their subscriptions. Expect to see more publishers follow suit in 2023 by giving subscribers more bang for their buck.

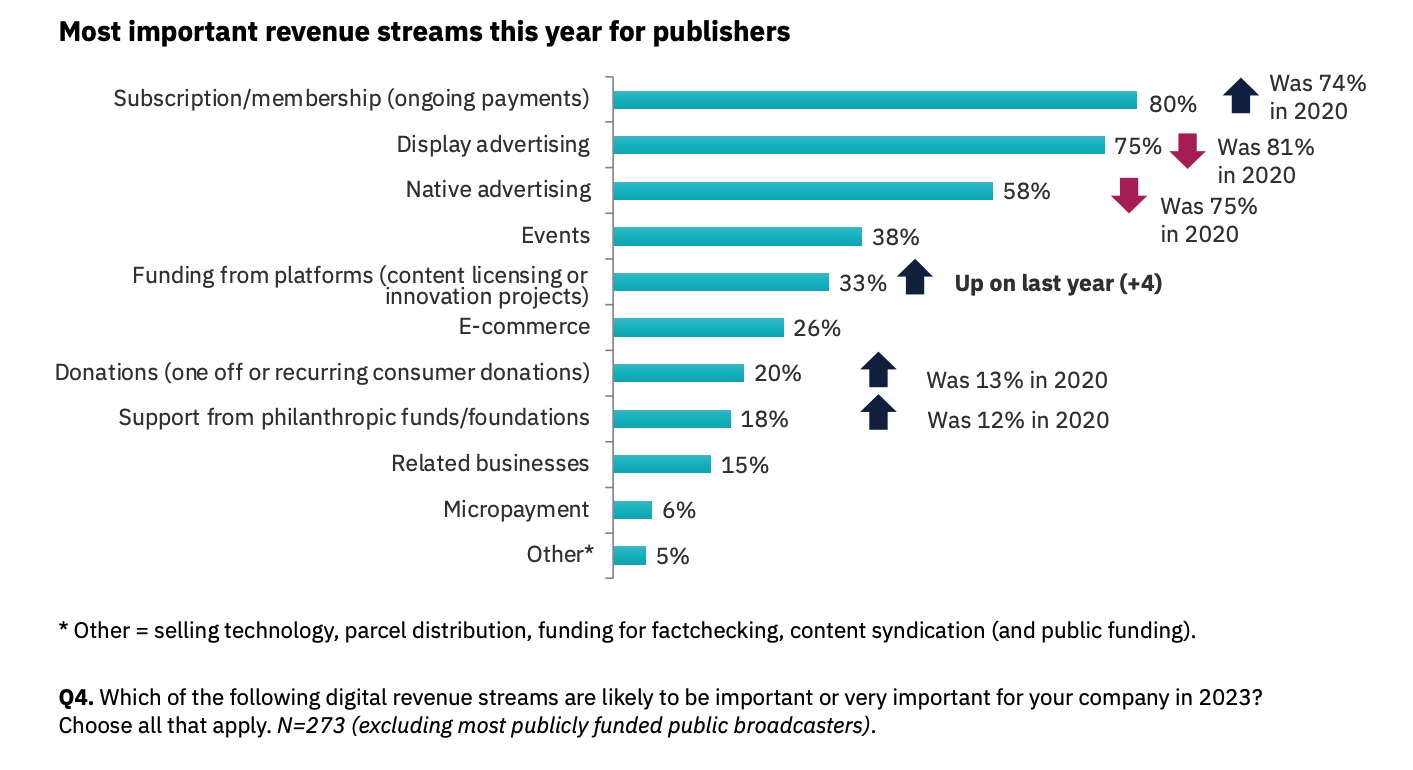

3. 80% see subscriptions as the key revenue driver for 2023

Optimism around subscription growth is reflected in revenue generation predictions for 2023. 80% expect subscriptions and memberships to be their key revenue driver for 2023. Insecurity remains around the prospects of revenue from display advertising (75%) and native advertising (58%). Despite growing discussions in 2022, just 6% of interviewees expect micropayments to be a revenue generator in 2023.

33% believe funding from platforms will be an important revenue stream, up 4%. Relationships between publishers and platforms have been shaky but in 2022 more publishers struck copyright deals for their content. 300 publishers across the EU now get money from Google for their content, whilst Meta have paid up to $20 million for content featured in their news section. But, some deals are set to expire in 2023 and Meta reportedly plan to continue their divorce from news by cutting funding in the face of their own losses, with stock falling 66%.

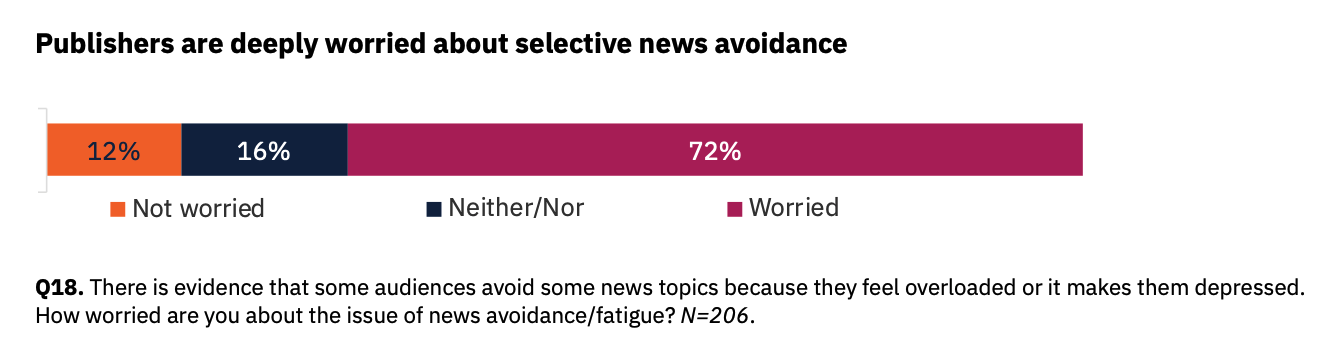

4. News avoidance is on the mind of 72% of news executives

A key concern on news executive’s minds is news avoidance. In their 2022 Digital News Report, Reuters found that 38% of people actively avoid the news, therefore it is no surprise that 72% of publishers are deeply worried about the trend.

News avoidance has been reflected in publisher’s web traffic, with 58% reporting static or declining traffic to their websites in 2022. Some publishers, like Schibsted (who prefer to call them news outsiders), have started to take action against growing news avoidance, and in 2023 more publishers will be looking at how to engage these readers.

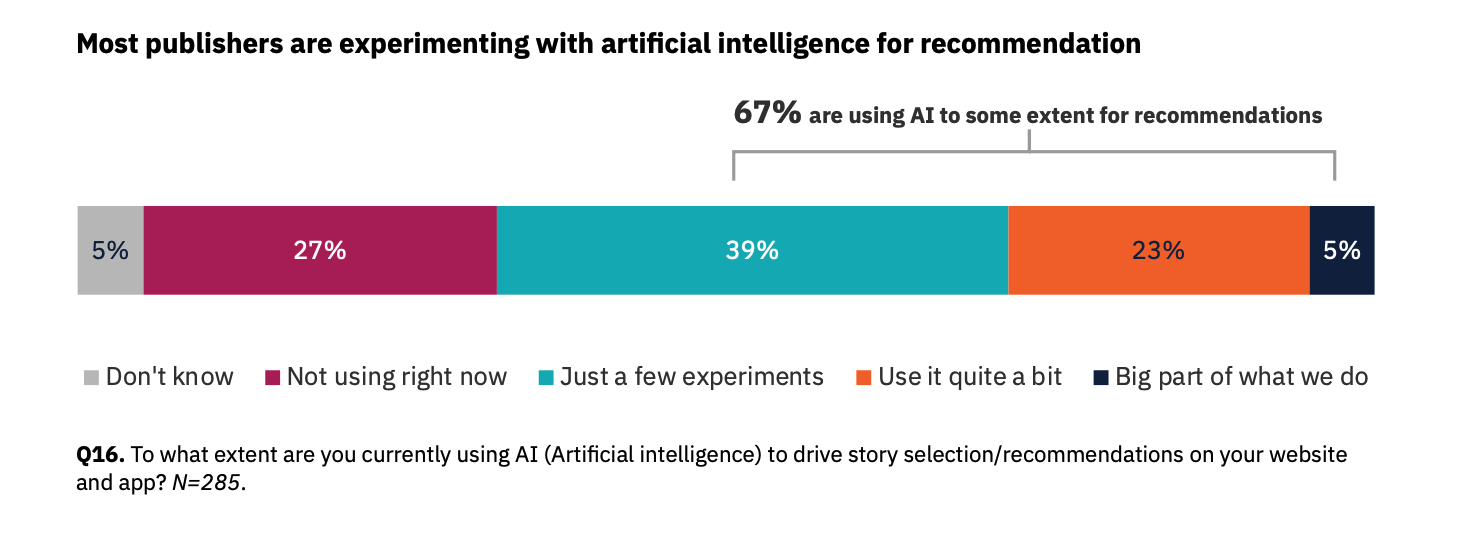

5. AI recommendations are leveraged by 67% of publishers

Whilst generative AI garnered much attention in the second half of 2022, its usage remained limited at news outlets. AI recommendation systems though have grown in their adoption. 67% of publishers now use AI recommendation tools like JAMES to engage their subscribers.

Subscriber retention will be a key focus for 2023 and these recommendation tools help boost engagement by surfacing content relevant to subscribers. With this engagement focus in mind, perhaps 2023 is the time to try out personalisation?

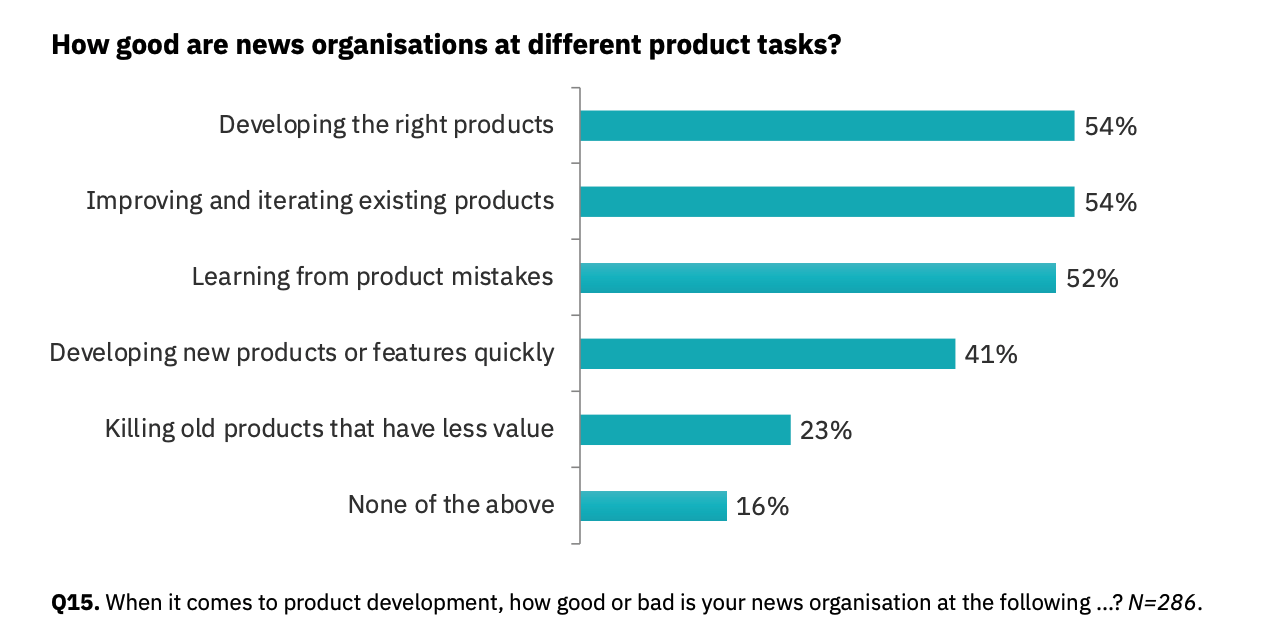

6. Product teams are more confident with development

Product has become a vital skillset for publishers in the digital age, and it appears publishers are becoming more confident in the area. 54% believe that their news outlets develop the right products and are good at iterating and improving them.

One of the biggest barriers identified to achieve product success was speed. Developing new products and features quickly is something just 41% believed their organisations were good at. Difficulties retaining technical and product staff is one of the reasons identified for this. As a result many publishers choose to go to external providers like Twipe for expertise driven product innovation.

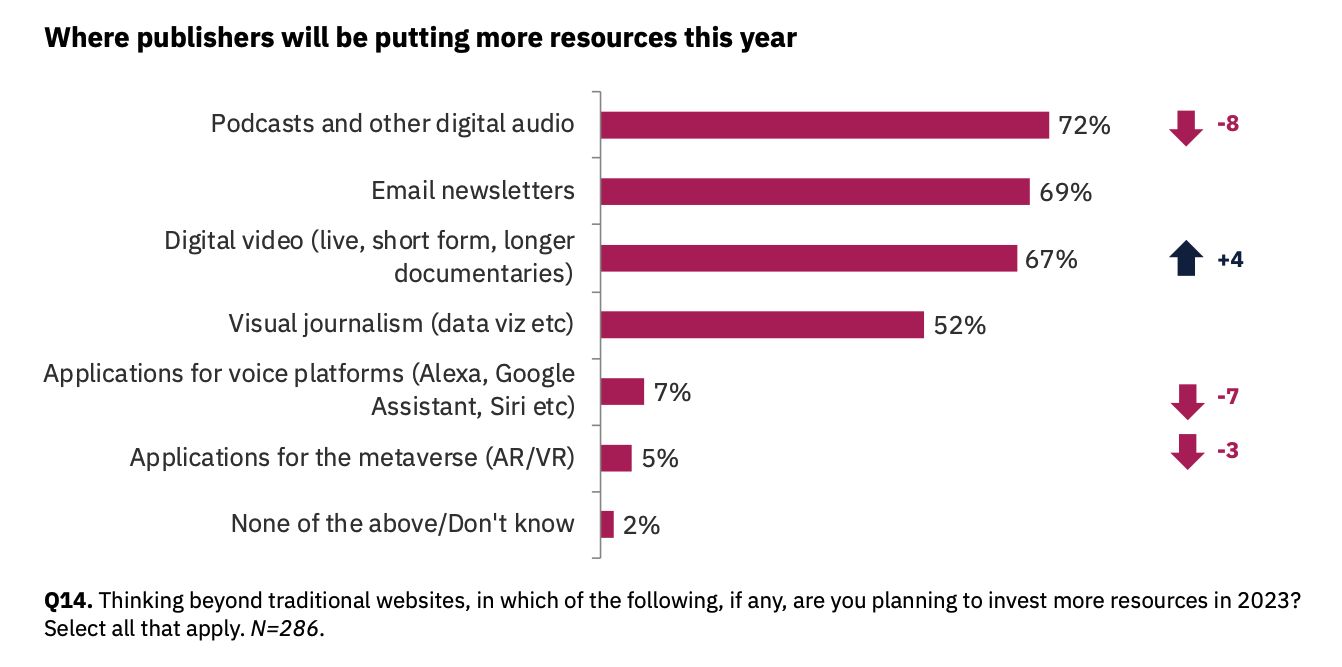

7. Finite formats see increased focus from product teams

With struggles around print expected to continue in 2023, product teams are looking to development in other areas. It is no surprise that this product focus will be centred around finite formats which can add value to existing news bundles. 72% plan to focus on podcasts and audio, 69% will leverage email newsletters and 67% are betting on video.

These are positive moves as publishers look to ease the burden of the heavy newsflow on their readers. Developments around the email newsletter focus is interesting. Platforms like Facebook and Twitter have discontinued their newsletter tools whilst LinkedIn’s newsletters are gaining traction, but publishers seem to be focusing on their own email resources to manage newsletters.

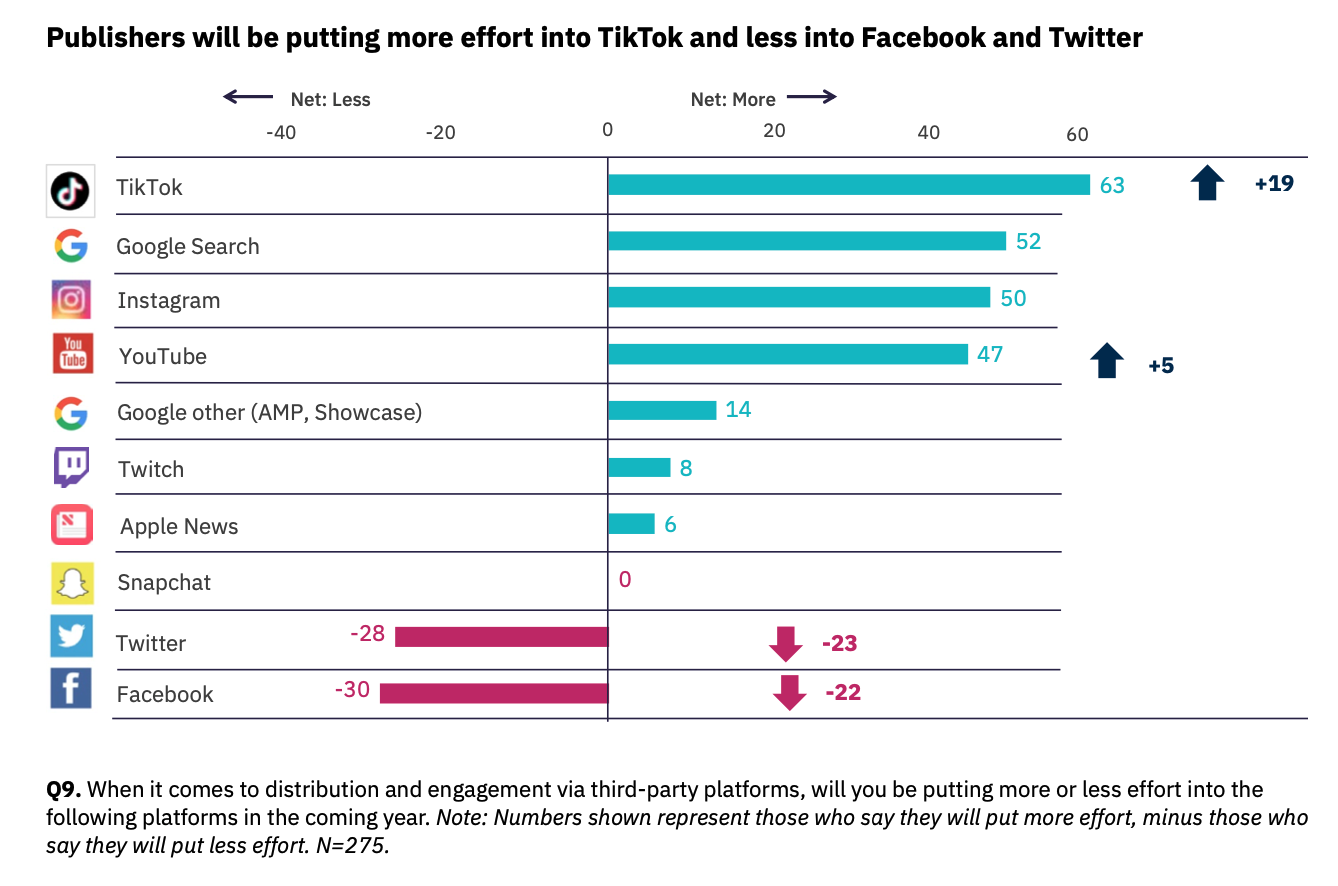

8. Platform power is seeing a significant shift

Publishers are also planning to accelerate their move from Facebook. The platform received a -30 net score in planning for publishers. As many would have expected, the TikTok rise continues with a +63 net score, up 19 points from 2022.

This switch to TikTok is no surprise in battle for eyeballs and with an increased focus on video products. 40% of young people now use TikTok or Instagram as search engines. But, regulatory discussion around TikTok will continue in 2023 as more governments look to vet its addictive algorithm and spread of misinformation. Research shared by Reuters from Newsguard found that in 2022, news TikTok users were exposed to misinformation about the Ukraine war within 40 minutes of usage.

Other Blog Posts

Stay on top of the game

Subscribe to Twipe’s weekly newsletter to receive industry insights, case studies, and event invitations.

"(Required)" indicates required fields