Blog

Subscription Pricing: Learnings from publishers who dared to experiment

Subscription strategies can offer a sustainable financing strategy. By now, the majority of the news industry knows this. The pitfalls of focusing digital strategies on advertising revenue are already well documented, but this recent piece in The Atlantic from Josh Marshall serves as a timely reminder.

Subscription pricing however is an issue where the industry is still barely scratching the surface. As pointed out by Gannett‘s new CMO, Mayur Gupta, “In news media we are re-doing our product-market fit”. Perhaps the place where this is best reflected in is in the variety of experiments with subscription offerings and pricing. A study of our team at Twipe found that there are at least 11 different types of subscriptions that newspapers offer to readers. It’s a topic of interest also for a group of students from KU Leuven University who are running a survey on subscription preferences – you can help them by taking the survey here.

In a report published last week INMA have also explored subscription pricing strategies. Join us as we highlight some of the key cases and takeaways below.

Pricing for Growth vs. Pricing for Retention

The balance between growth and retention is key when defining subscription prices. The focus ultimately depends on where you are in your digital journey.

If you are just starting out, it is natural to focus on growth. By placing a new product below the average price threshold, it makes it easier for it to gain momentum and grow an audience. Becoming over reliant on this however creates unsustainable business models.

Generally speaking, news companies charge their best and most engaged customers more money. These loyal readers must receive value for money. Performing your own tests helps you to find out how customers respond to price changes. Considering customer lifetime value is of paramount importance when creating a pricing strategy. The long-term impact of changes will ultimately have a larger overall business impact.

It may be tempting to do free trials to grow your subscriber base. Even at a relatively low price like $1, paid trials retain 81% when the trial period is over compared to free trials which retain 70% when users have to start paying.

Boston Globe experimented with a strategy to bring growth and retention. The Globe hosted a one-day sale, offering 6 months of access for $1 as opposed to 99 cents a week for 4 weeks. This offer brought 1728 new subscribers within 24 hours. These readers had a higher engagement rate and their conversion rate into subscribers was 10 times higher.

Following this success, The Globe have shifted their subscriber strategy to focus on the long-term offer. Since mid-2019, 80% of new subscriptions have been on a six to nine-month introductory offer. The long-term retention between long-term and short term trialists is identical. This approach has enabled The Globe to maximise their reader revenue and manage growth and retention.

Dare to offer long-term subscriptions

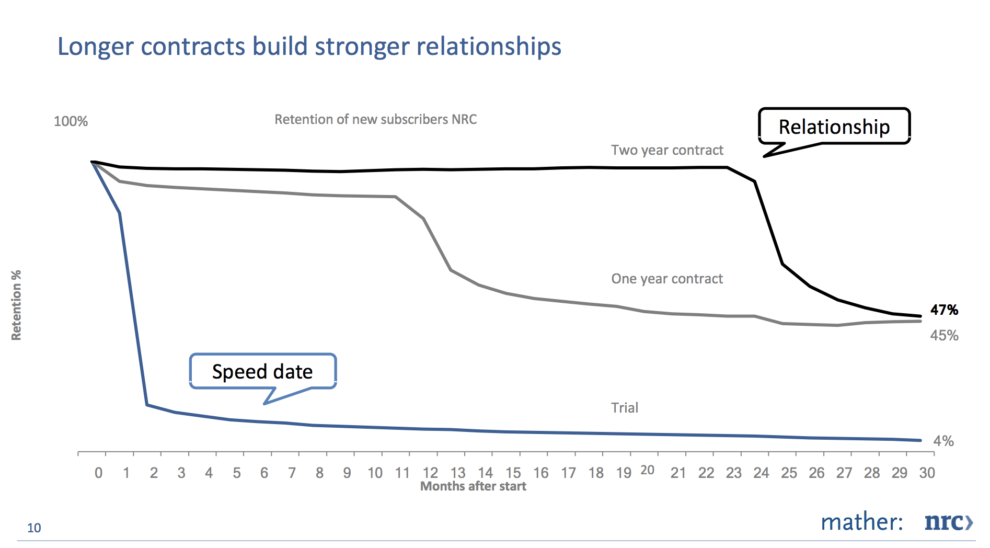

While Boston Globe explore 6 to 9 months offers, Dutch publishers De Telegraaf and NRC dared to go much further and explore the limits of subscription terms. In a thought-provoking analogy with romantic relationships, Xavier Van Leeuwe, Director of Consumers at Telegraaf Media Group and Matthijs van de Peppel, Director of Marketing, Data and Customer Care at NRC Media challenged publishers to start dating their readers. Van Leeuwe argues that “Most publishers don’t dare to offer long term contracts, as they are afraid to scare off readers”. But is this the case?

“Dating” your customers is the most effective way to understand the relationship you actually have with them. Once this understanding is established, then building the relationship you actually want with your readers should be your sole focus. In their research, De Telegraaf and NRC found that longer contracts build stronger relationships.

De Telegraaf have seen annual subscription growth of 66% while also seeing a 24% fall in marketing costs. Elsewhere at NRC, trial periods are no longer part of the plan. Instead, they have just three subscription offers available for customers. These are contracts of 1, 2 or 3 years. These longer term contracts have proved successful and help NRC to build stronger relationships with their customers.

Tailor prices to your reader’s situation

As humans, we love to feel that we are getting value for money, especially when times are hard. In fact, publishers who offered readers trials or offers during COVID-19 outperformed those who did not in terms of subscriptions.

Slovakia based Denník N introduced a series of special offers to new subscribers to encourage growth in their subscription base. After finding that subscribers paying higher fees read less, Denník embarked on an experiment that has seen them offer an impressive 305 special subscription offers.

During the COVID-19 pandemic, Denník introduced a series of special offers. These ranged from buy-one-year get-one-free to an honesty based special offering customers 50% off if they had been affected by COVID. These offers have provided huge successes to the team at Denník N. The buy-one-get-one-free offer saw Denník sell €500,000 in subscriptions in one day, something that normally takes them four to six weeks.

Special offers mean that customers pay differing amounts for the same products across a period of time, and Ken Harding, senior managing director at FTI Consulting tells us that this is completely normal. Harding states that “the average revenue per user (ARPU) can’t be the same across all users”.

Data driven pricing

Many publishers base their prices by looking at their rivals, however this is not always successful. Others take Netflix as the golden shrine and try to compare their value to the streaming giant, but even Netflix are raising their prices. If Netflix are daring to raise their prices, surely news publishers can too?

In 2016, Danish publisher Politiken introduced a 400% price increase on digital subscriptions. This price increase was introduced after an analysis of their digital performance to drive their revenue growth. Politiken highlighted that their ambitious tripling or quadrupling of subscribers was unrealistic therefore a price increase was the only way to grow their reader revenue.

By using various tools such as the introduction of an ePaper and focusing on its’ customer journey, Politiken justified their price increase to customers. The value of these products proved powerful and readers found these additions worthy of the higher price. Since the price increase, Politiken’s subscriber revenue has risen by 8.4%. Politiken is now at a sustainable 80/20 subscriptions/advertising revenue split.

Other news publishers have also seen their ePaper drive subscription revenue. Neue Westfalische added the ePaper to their subscriptions and this has proved to be an equally effective strategy.

Whilst this is a major success for a data driven pricing shift, it is vital to offer your readers quality products that can offer a pay-worthy experience. Premium ePapers and digital editions can play a big role in positioning your subscription offerings. If you want to get started with similar digital journey, book a demo call with us.

Other Blog Posts

Stay on top of the game

Subscribe to Twipe’s weekly newsletter to receive industry insights, case studies, and event invitations.

"(Required)" indicates required fields