Blog

Reuters Digital Report 2022: Key Learnings

Reuters Institute for the Study of Journalism have released their Digital News Report for 2022. We have compiled some of the key insights from the report based on a survey of 46 markets for your reading (or listening) pleasure.

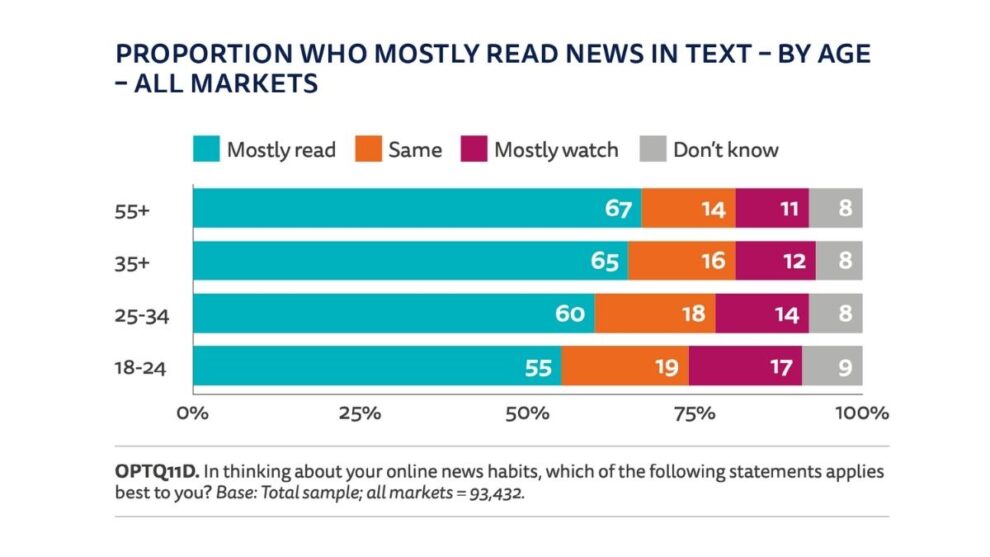

People prefer to consume their news in text rather than video

Facebook has continued its general decline in usage but remains the key social media platform for news consumption. Instagram, TikTok and Telegram are the only social media platforms to see usage growth. These trends have been particularly due to the usage habits of 18–24-year-olds.

TikTok usage has grown rapidly, mostly amongst under 25-year-olds. 40% of 18–24-year-old use TikTok for any purpose whilst 15% use the platform for news. Key reasons Reuters found for this in their qualitative research included the fact that these social feeds were more personalised and diverse than TV. With this rise, publishers have increased their investment in video strategies. Worries remain that news content may not be greatly sought after amongst an ocean of entertainment.

Despite video content uptake across platforms, text remains the number one format for people to consume news across all age groups. This is good news for legacy publishers who have often struggled to replicate their success on video platforms, especially on social media.

Obvious reasons for this text preference include that it is quicker to consume news on (50%) and text gives more control (34%). A dislike for pre-roll ads puts off 35% of people from video news, whilst 17% don’t believe that video adds anything to text stories. Those who prefer to consume video content find it an easier (42%) and more engaging (41%) format. 24% cite that is more convenient as it already appears in their social media feeds. The relationship with video continues to be a struggle for publishers, but it appears to be a must for Gen Z.

Subscriptions are steadying with a trend to have more than one

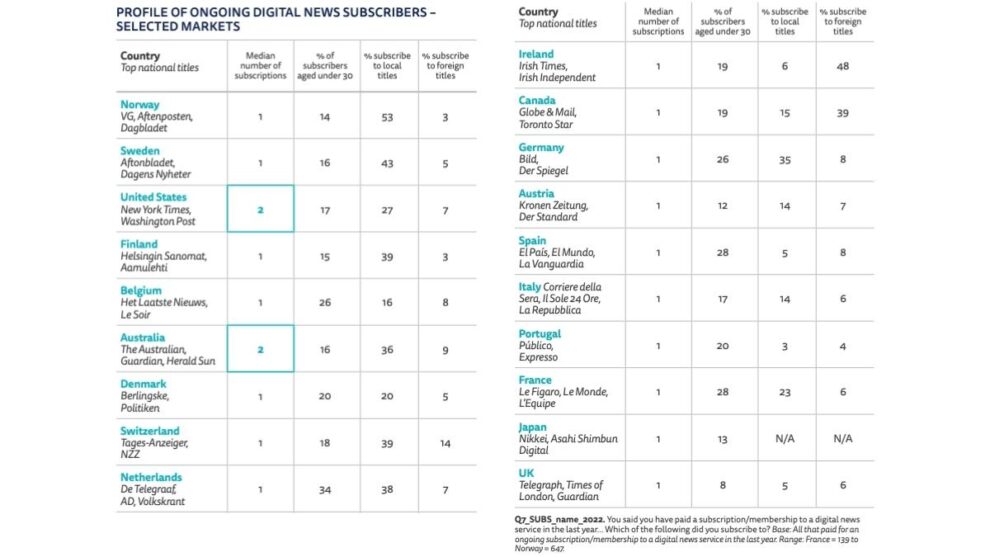

Subscriber revenue is the number one priority for publishers as we saw in Reuters 2022 Predictions, but growth has settled. An unchanged figure of 17% of people pay for online news, with the Nordics remaining a paradise for publisher payments. Norway leads the way with 41% paying for news, with Sweden following on 33% and Finland at 19% (tied with the untrusting USA).

Despite much discussion about subscription fatigue, Reuters note that news publishers could be less impacted. Most respondents expect their number of media subscriptions to stay the same, a more optimistic picture than expected. News subscribers tend to be older and wealthier with more disposable income. For them, news is not seen as a luxury service but as a necessity and they are likely to be less impacted by the cost of living crisis.

Publishers must continue to develop their products by investing in quality features like editions to give subscribers value for money. The role of newsletters has increased as publishers increase loyalty with these readers and introduce more personalisation to surface the correct content. 17% use newsletters weekly, highlighting the convenience of the format (65%) and diverse perspectives (30%) as reason for using them. Over 80% of those who use emails for news are 35 or over in the US, so they can be a great tool to build paying relationships with traditional subscribers.

Australia (51%) and the US (56%) have a majority of subscribers who pay for 2 publications. In the US, this tends to be a national and local or cultural/niche news combinations. Australians pay for platform-based news or US/UK based publications as their second title. This trend is not widely reflected but is a development to be monitored closely. People remain willing to pay for the news so publishers must boost acquisition efforts.

The average digital news subscriber is 47 and publishers struggle to attract younger audiences

Publishers are struggling to convince younger generations to subscribe to news. The story is particularly bleak in the UK. Just 8% of news subscribers are under-30 compared to 34% in the Netherlands. Younger generations have grown up in an era with free online news. In a world where they are more likely to pay for entertainment subscriptions such as audio and streaming, paying for news is not a habit for them.

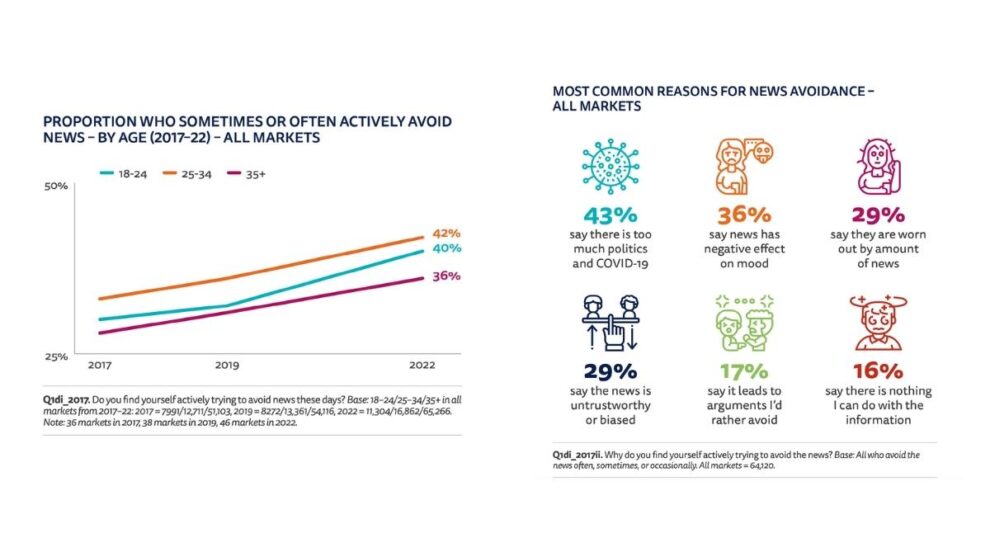

A concern for younger generations is that the news is becoming more complex. 15% of younger news avoiders explained that they don’t consume news because it is hard to follow. A significant proportion of the 36% who don’t consume news because it brings down their mood also come from the under-35s. Finding a balance between accessible and engaging content and the world’s events is a challenge that publishers will have to rise to to win over younger generations.

Unlike Millennials, Gen Z’s news habits are significantly different to older generations. Gen Z have grown up with social media from a younger age than their millennial counterparts. Their news journeys are most likely to begin, and even stay, on social media. How can publishers better meet them there or bring them to their products?

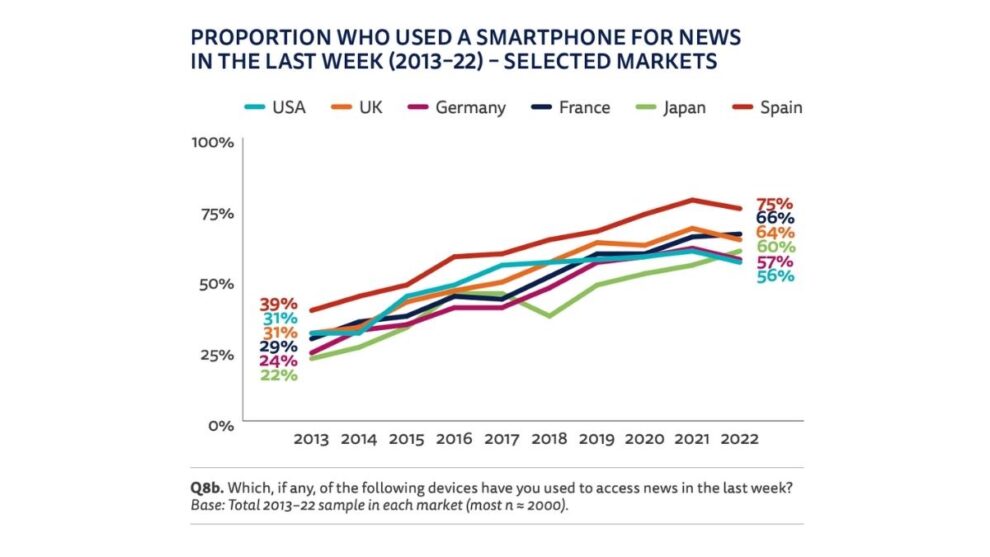

Mobile continues its rise, particularly in the mornings

Mobile remains the number one device for news consumption, but 2022’s report hints at the first decline in weekly access in 11 years. Dependence on the smart phone as the starting point for news journeys has grown significantly over the past 3 years. In Norway, Spain, Finland and the UK mobile has overtaken other sources to the number one spot. Somewhat surprisingly, morning newspaper consumption is first in the Netherlands and Finland, whilst TV news dominates the US, France, Italy and Japan.

The smartphone is the device of choice for under-35s. 47% used smartphones as their first device, compared to 28% of 35s and overs and 15% of 65s and older. On smartphones, social media has overtaken news websites and apps as the favoured channel to begin news consumption by 39% to 31%. Aggregator apps like Apple News continue their low pickup with just 9% using them to begin their news journey. Mobile appears to be the device of choice in Web2, so what trends will we see in Web3?

The story of social media domination continues in general news consumption. 28% highlight social media as their preferred access point, moving ahead of the 23% who prefer direct access. Social domination is being driven by the habits of the next generation of social natives becoming adults. Direct traffic is more common in Europe, with social traffic coming from elsewhere.

Trust in the news is fading away

After picking up during the pandemic era, trust in the news has dropped to 42%. Lower levels of trust have been identified in 21 of the 46 markets surveyed. 18 markets maintain a similar level and just 7 witnessed an increase in trust. The truth may be different, however. Overall trust levels are higher than before the pandemic and the need for reliable news. The pandemic therefore may have done some good for the reputation of publishers.

Either way, the figure of 42% is low. The story is most worrying in France, where just 29% of people trust the news, and the US with a joint global low of 26%. These levels have been consistently dropping for several years driven by a series of polarising events like the Gilet Jaunes protests in France and the Trump years in the US.

These countries also see some of the most significant levels of selective news avoidance, news disconnection and overall declining interest in news. 15% of people in the US and 8% in France say they are disconnected from the news. In the US, 42% actively avoid the news, alongside 36% in France. Political allegiances are a significant reason for this in the US. 65% on the right of the political spectrum avoid news because it is untrustworthy or biased. Trust is fading and work needs to be done to rebuild this relationship.

People don’t want to give publishers their data

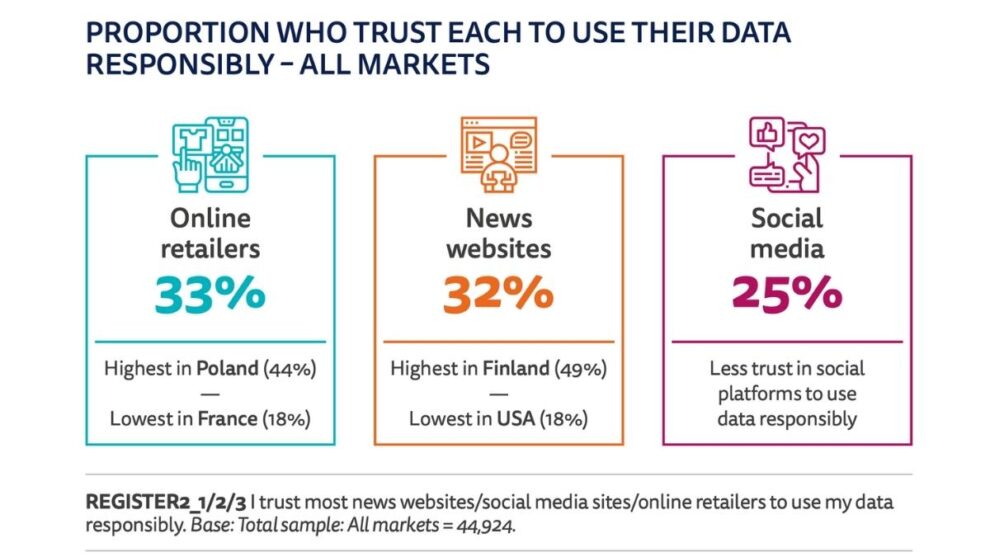

Alongside this lack of trust, consumers do not trust publishers with their data. Just 32% trust news websites to use their personal data responsibly, ahead of social media (25%) but just behind online retailers (33%). There is a clear link found by Reuters between trust in news and people’s willingness to trust publishers with their data. The 48% who have the highest levels of trust are over twice as likely to give up their data than the lowest trusting 19%.

Despite publishers betting big on first-party data in a cookieless world, registrations are not widespread. News readers do not want to provide publishers with their data. Just 28% of respondents registered for one or more news websites in 2021. Consumers are often able to find the same news stories free of charge at different outlets. Building up this trust will be fundamental for both subscriptions and building audience relationships. Can publishers rebuild trust?

Changes are afoot for publishers. Their digital presence will continue to develop and be crucial for future survival and revenue.

Other Blog Posts

Stay on top of the game

Subscribe to Twipe’s weekly newsletter to receive industry insights, case studies, and event invitations.

"(Required)" indicates required fields