Blog

6 Alternative Revenue Streams for News Publishers

Traditional revenue streams for publishers, particularly print advertising and basic subscriptions, are becoming increasingly unsustainable. As a result, there has been a notable shift towards diversifying revenue sources beyond traditional subscriptions and advertisements.

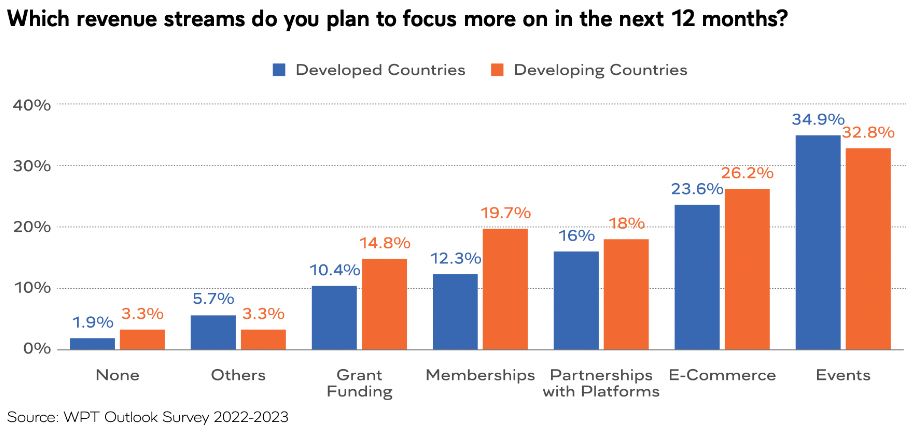

This revenue diversification is yielding positive results. According to the 2022 WAN-IFRA World Press Trends report, new revenue sources such as events, contract publishing, and e-commerce contribute approximately 17% to publishers’ total earnings, a remarkable 13% growth from 2021. Publishers anticipate that non-reader and non-advertising sources will constitute nearly 24% of their revenue in 2023.

Our latest blog post explores these emerging alternative revenue streams, highlighting how news publishers are adapting in challenging times for the print industry.

1. Bundling: Boosting Revenue and User Engagement in Publishing

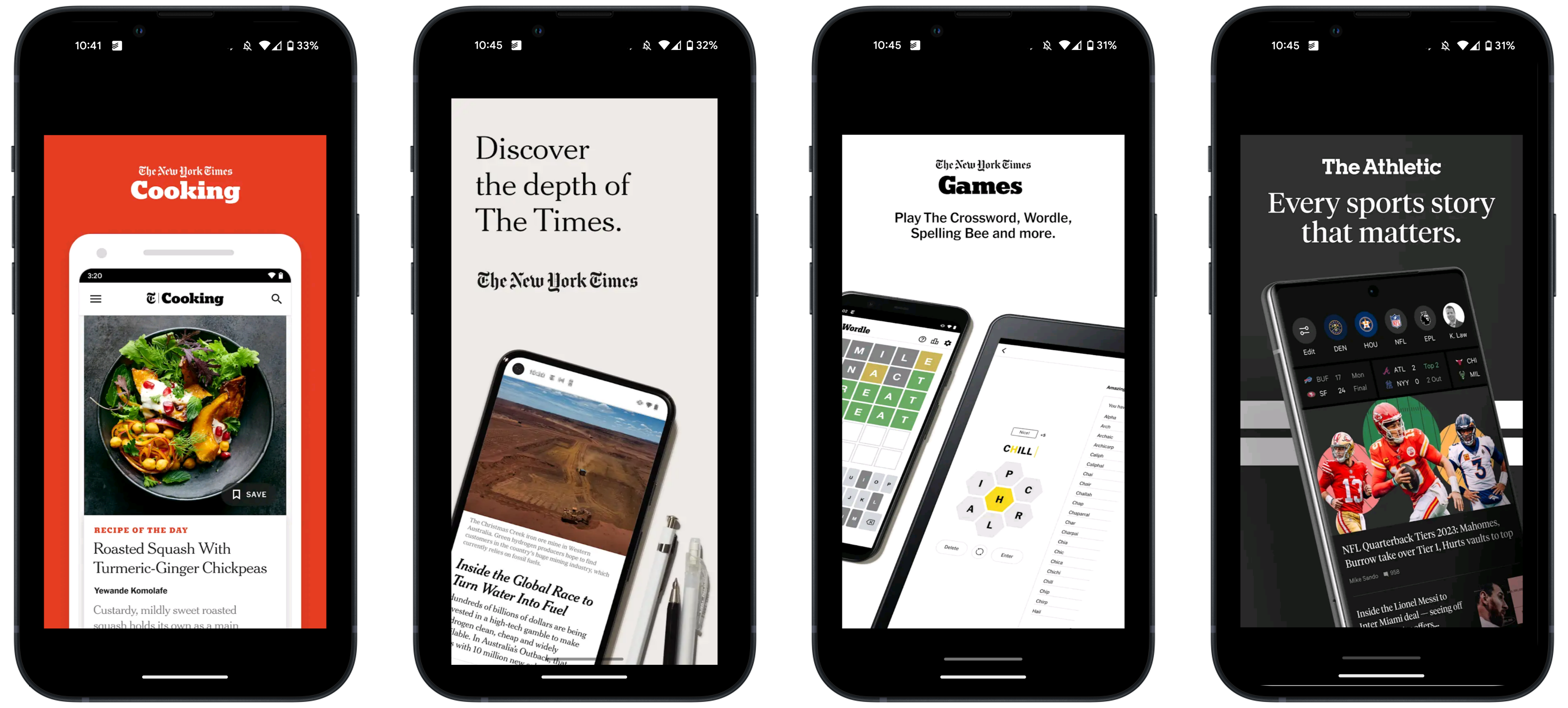

Bundling has emerged as an important strategy to increase publishers’ revenue, with The New York Times (NYT) leading the charge. Their bundle offers subscribers the option to group together a subscription package that can be paired across the core news offering, a cooking app, games and puzzles, Wirecutter reviews, and The Athletic sports content. This approach has become a major contributor to the company’s revenue growth, particularly as news fatigue leads to a decline in traffic for breaking news coverage. Currently, approximately 38% of the NYT’s subscribers are bundle subscribers, with access to multiple products. They aim to see this number grow beyond 50% in the coming years.

For the NYT, the financial benefits of bundling are clear. The average monthly revenue per user from bundle subscribers is 44% higher than the one for news-only subscribers. Offering a diverse range of products that surrounds and complements the core news service not only increases subscriber value but also enhances retention over longer periods.

Media conglomerate Schibsted is strategically embracing bundling as a part of its ambitious goal to double its subscription business by 2025. Traditionally, Schibsted’s revenue stemmed from subscriptions to individual titles within its portfolio. However, recognizing the evolving needs of their audience, the company is shifting towards offering bundled packages. This transition aligns with their vision of catering to a broader spectrum of consumer preferences by providing access to multiple titles simultaneously.

2. The Audio Revolution: Podcasts as a New Frontier for Publishers

With the Reuters Institute reporting a “rapid development” in audio articles and 80% of media leaders planning to increase their digital audio investments, it’s evident that audio formats like podcasts are no longer peripheral but central to news publishing strategies.

Case Studies: Major News Publishers Embracing Audio

- The Washington Post: By implementing audio articles, The Washington Post observed a threefold increase in user engagement time. Their focus on voice AI for scalable audio article delivery underscores the growing preference for multitasking-friendly news consumption.

- NRC: A Dutch publisher has created its own audio app which showcases NRC-produced podcasts as well as a set of curated third-party content. They created their own app in order to become more independent from the algorithms of other platforms. In 2022, 20% of their subscribers had downloaded the app.

- The Economist: The Economist tackled the ‘unread guilt factor’ among its subscribers by offering audio editions. This initiative retained existing subscribers and appealed to a broader audience who prefer audio over text.

Advantages and Challenges of Audio Content for Publishers

- Enhanced Engagement and Retention: Audio formats have proven to be highly engaging. For instance, Zetland experienced an average completion rate of 90% for its audio stories, indicating that listeners are more likely to consume entire pieces than text.

- Diverse and Younger Audience Reach: Audio content, especially podcasts, has broadened the audience base for news publishers. It has been particularly effective in attracting younger and more diverse demographics, a crucial factor for sustaining and growing a reader base.

- Financial Benefits: Introducing podcasts and audio articles has opened new revenue streams. The first quarter of 2022 saw a staggering 500% increase in digital audio revenue among publishers, highlighting the lucrative potential of this medium.

While integrating audio content offers numerous benefits, it also presents challenges, such as the need for specialized skills and technology. However, many publishers have overcome these challenges by forming partnerships with audio apps, which allow

3. Beyond the Page: Publishers’ Strategic Shift to Event-Based Earnings

Online events have proven to be a successful strategy for publishers for several reasons, most notably:

- Their flexibility allows for various themes and formats, from industry discussions to cultural galas and educational webinars.

- They foster community engagement and can be catered to different audiences (public, B2B, industry, etc.).

- They are publishers’ natural extension of their skill set in content creation, repurposing content into live experiences.

- Advertisers are drawn to these events, attracted by the visibility and engagement opportunities they present.

In fact, over a third of publishers intend to focus more on events as a revenue source in the future.

Outlets like Axios, Bloomberg, and Semafor have incorporated events as a central part of their revenue strategies and observing significant success. Smaller publishers have also seen similar successes, whether it be organising events to showcase homes in Texas or a food festival in Utah.

The British music magazine New Music Express (NME) is another standout example. After discontinuing its 66-year-old print edition in 2018, NME, now under the Caldecott Music Group, has transformed into a ‘next generation media company’, expanding into gaming, events, and films. The launch of NME Screens, a venture into curating preview screenings with various studios and streamers, marks a bold step in their evolution. NME’s focus on events as a revival strategy is a fascinating development, illustrating the potential of this avenue for publishers seeking new revenue streams.

4. Balancing Profits and Principles: The Challenges of Native Advertising in Journalism

Native advertising, also known as branded content or advertorials, has emerged as a significant trend. This approach involves the sponsored publication of articles that blend into the style and format of editorially produced content. Major publishers like The Guardian, Forbes, Financial Times, The New York Times, and even the BBC have adopted this strategy. While it can be financially beneficial, the use of native advertising is often hotly debated.

One of the primary concerns with native advertising is the potential confusion it can cause among audiences. Readers might not immediately realize that the article they’re perusing is, in fact, sponsored content. This lack of clarity can lead to a trust deficit between the publication and its audience, as readers may feel misled upon discovering the true nature of the content.

Another contentious aspect of native advertising lies in the internal dynamics of newsrooms. The financial ties to advertising partners can inadvertently lead to self-censorship. This scenario often manifests as a reluctance to publish content that might cast these partners in a negative light. Such a practice not only undermines journalistic integrity but can also inflict reputational damage on the news outlet, casting doubt on its commitment to unbiased reporting.

Despite these challenges, native advertising represents a vital revenue stream for many publishers, especially in an era where traditional sources of media income are dwindling. The key to harnessing this opportunity without compromising ethical standards lies in transparency. Clear labelling of sponsored content and maintaining a strict separation between the editorial and advertising departments can help mitigate the potential pitfalls. By doing so, publications can enjoy the financial benefits of native advertising while upholding the trust and respect of their readership.

5. E-commerce Expansion: How Publishers Are Capitalizing on Online Retail and Affiliate Marketing

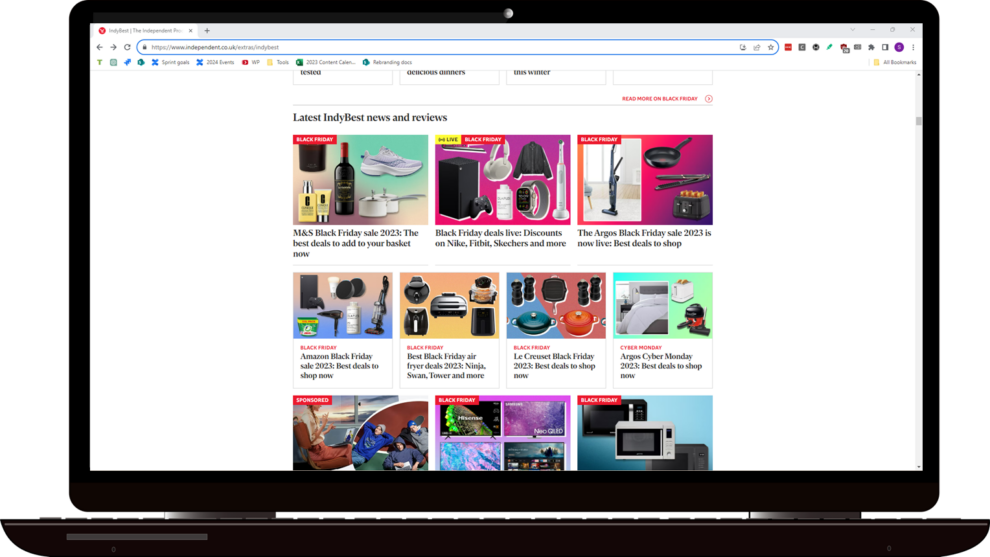

A significant portion of publishers are using affiliate marketing to diversify revenue. The growth in publisher revenue from e-commerce is substantial, with major players observing an 80% increase from 2020 to 2022.

Recognized for its “Indy Best” series, The Independent has made e-commerce one of its four priority areas, contributing to around 10% of all revenue. The site’s focus on quality shopping experiences, leveraging its brand relationships, and investing in data analysis for better product understanding has significantly boosted its e-commerce revenue.

With a long-standing authority in men’s fashion, GQ has intuitively integrated shopping into its content strategy. Its e-commerce revenue has grown annually since 2017, leveraging tools like curated shopping guides and GQ Recommends email alerts. GQ’s focus on quality over quantity and expansion into lifestyle categories has further enhanced its e-commerce success.

Hearst has ventured into digital subscriptions with unique products like a $100 per year exercise video service, All/Out Studio. This service, along with other products like the Backslash Fit yoga mat and “Keto for Carb Lovers” cookbook, showcases Hearst’s strategy to diversify revenue and capitalize on their brands’ strengths.

Strategic Considerations:

- Investing in quality content, like reviews and recommendations, is key to driving e-commerce success.

- SEO strategies and subscriber traffic are vital for enhancing e-commerce visibility and performance.

- Publishers are exploring new avenues, like shoppable video content and social media platforms, to expand their e-commerce reach.

6. Beyond Subscriptions: Donations and Nonprofit Models in Publishing

Donations are a significant source of revenue for several publishers. The Guardian and La Presse have notably adopted this approach, each taking a unique path to leverage donations as a sustainable revenue source.

Faced with financial challenges, The Guardian successfully implemented a donation-based model without a paywall. Key to this strategy was its status under the Scott Trust, promoting itself as a public good. Transparent reader engagement strategies and mission-driven messaging supported effective donation drives. This approach, coupled with a soft registration wall for data collection, led to a significant financial turnaround and membership growth.

Transitioning to a nonprofit model, La Presse sought government and philanthropic funding. This shift allowed for a reimagined approach to journalism, focusing on digital platforms like tablets to reach wider audiences. The move to nonprofit status was strategic, aiming to sustain quality journalism through diversified funding sources, including potential government support.

Takeaways for Publishers

- Diversification is Crucial: The success stories of publishers who’ve embraced events, e-commerce, podcasts, and bundled services stress the importance of not relying on a single revenue stream.

- Leveraging Brand Strength: Publishers should capitalise on their established brand and audience trust when venturing into new domains like e-commerce or events.

- Quality and Ethical Standards: Maintaining high-quality content and clear ethical standards, especially in sponsored content, is vital to retain audience trust and credibility.

- Audience Engagement and Retention: Innovative approaches, whether through interactive events or engaging audio content, help deepen audience relationships and loyalty.

How can publishers explore alternative revenue sources?

- Assess and Leverage Existing Assets: Publishers should evaluate their current strengths, such as content creation, audience reach, or brand reputation, and consider how these can be adapted to new revenue models.

- Invest in Technology and Skills: Venturing into areas like e-commerce, digital events, or podcasts requires investing in relevant technologies and skill sets. Training existing staff or hiring new talent with the required expertise can be a significant first step.

- Collaborate and Partner: Forming partnerships with tech companies, e-commerce platforms, or other media entities can provide the necessary infrastructure and expertise without significant upfront investment.

- Test and Learn: Implementing new revenue streams should be approached with a ‘test and learn’ attitude. Starting with smaller initiatives can help understand what resonates with the audience before scaling up.

- Maintain Transparency and Integrity: As publishers diversify, maintaining transparency with the audience, especially in areas like sponsored content, is crucial to sustaining trust and loyalty.

- Focus on Audience Needs: Understanding and responding to audience preferences should be at the heart of any new strategy. This involves leveraging data analytics to gain insights into consumer behaviour and preferences.

Other Blog Posts

Stay on top of the game

Subscribe to Twipe’s weekly newsletter to receive industry insights, case studies, and event invitations.

"(Required)" indicates required fields