Surprising subscription growth across the world

The pandemic accelerated success for publishers big and small. As we approach the end of 2021, it is a great time to celebrate some of the subscription success across the globe.

From 0 to 120,000

Building a subscription business is a tough challenge, especially from scratch. But, El Pais saw their subscription launch accelerated by the pandemic. For over 2 years, they had scheduled their launch for 1st March 2020, but their plans were fast forwarded. El Pais had been slow to introduce their subscription business. This was partially due to the unpopularity of their first paywall, introduced in 2002. The debate as to whether to install the paywall during a pandemic then ensued amongst the senior management. This reluctance and pandemic acceleration, did not hinder the rapid digital growth of El Pais. After their launch, El Pais went from 0 to 100,000 digital subscribers in only 12 months. This figure now stands at 120,000 after 17 months and represents the majority of the 145,000 El Pais subscribers.

Central to their subscriber strategy had been the introduction of a registration wall in 2019. By gradually increasing the amount of content that went behind the registration wall, the collection of audience data proved critical and got readers into the habit of consuming news from the El Pais platforms. Leaving readers wanting more only available to them as a subscriber was therefore a natural next step in the reader journey. According to Borja Echevarría, Managing Editor of El Pais in an interview conducted at WAN-IFRA’s News Room Summit, 80% of El Pais subscribers have come from registered users.

So what: This signals clear success for the role of a registration wall and can serve as encouragement for publishers that registration walls can work for them too. Do this and de-anonymise your readers.

“Bild”-ing on Digital Success

Bild has built on its success of being Germany’s highest selling newspaper. For a publisher witnessing 25 million visitors each month to their website, they have managed to convert 540,000 into digital subscribers. Over 70% of Bild’s traffic is direct traffic. This is promising in terms of both monetisation for the publisher, and brand recognition. With this vast numbers of visitors per month, Bild’s potential in their own digital market is huge. But even still, to have a base of 540,000 subscribers in a local language such as German is no mean feat. This success sees Bild bring in over half of Axel Springer group’s subscribers.

Not wanting to stop their growth here, Bild have decided to expand their offering beyond newspapers. Ahead of September’s federal elections in Germany, Bild chose to launch a free-to-view TV channel in Germany.

This decision was based on the fact that Bild know that their audience love video formats. In launching their TV channel, Bild aim to take their viewers to the heart of the story with their 500 strong reporter base across Germany. The content for their live news programme, which runs 6 hours a day, comes directly from Bild’s editorial team. With this expansion, Bild hope to feature at the forefront of consumer’s lives. They aim to become the number one place for consumers to learn more about the stories of the day. Monitoring the reach and success of Bild will be fascinating.

So what: The subscription economy also has potential for tabloids. Be the go to place for your consumers.

US giant goes global

In a country of over 331 million people, breaking into the national market is difficult. But in the USA, The New York Times has gone beyond their national market: they have gone global.

The New York Times have been very open about their aim to have 10 million paying subscribers by 2025. Currently, The New York Times is the news publisher with the largest paying subscriber base. According to their latest statistics, the US publisher has nearly 8.4 million subscribers, of which 7.6 million are digital. To put this in context, the USA has a population of around 331 million. Of this, around 258 million cite English as their first language. When removing the 1 million digital subscribers based outside of the USA, it is particularly powerful to find that over 2.23% of the US population have a subscription to The New York Times. When exploring this number for those with English as their first language, the percentage increases to a staggering 3.49%.

Their growth since introducing their paywall in March 2011 has been significant. By reclaiming utility and going beyond their pure journalism focus, The New York Times have leveraged their growth potential. Their subscription wins have also been reflected in their podcast success, with The Daily coming in as the number one English-Language News podcast. Clearly, The New York Times are well on their way to reaching their 10 million subscriber goal.

So what: Reclaiming utility and being more than “just a newspaper” can build new habits.

UK broadsheets broadening their appeal

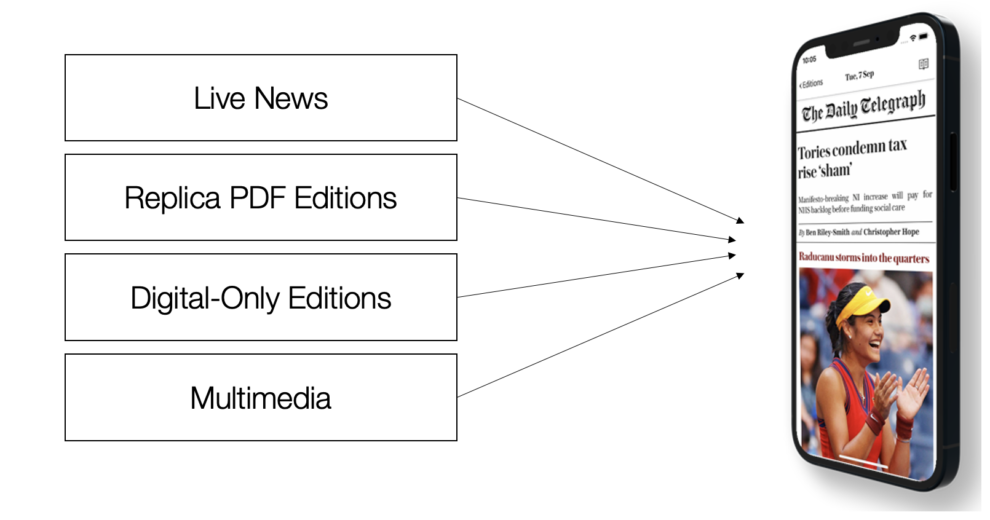

One of the fastest growing publishers over the past 12 months in the English-language market, according to the Press Gazette, is The Telegraph. After reporting a 45% increase in digital subscribers in 12 months in October 2021, The Telegraph now have more than 500,000 digital subscribers in their midst. This growth is extremely promising in The Telegraph’s bid to reach 1 million paying subscribers by 2025.

Crucial to this growth has been their digital edition. By unifying their app experience and bringing it all into one place on Twipe’s NextGen platform, their user experience has been both simplified and centralised. Louise Curtis, Product Manager at The Telegraph described the new unified app as the number 1 place to consume The Telegraph’s journalism.

Elsewhere in the UK market, the progress on The Financial Times is one to follow. Currently on 987,000 digital subscribers (September 2021), the FT are close to being the first UK-based publisher to reach 1 million digital subscribers. The FT launched their digital subscription business in 2001, but their general financial reach means that a significant proportion of their paying readers are based in the USA. Finance clearly has a global reach, especially in the English language.

So what: Product is central to a successful subscriber strategy. Don’t be afraid to unleash your product potential.

4 pillar push

In the non-English speaking world, Japan’s Nikkei is the newspaper with the highest subscriber base. Back in 2010, Nikkei became the first Japanese newspaper to use a paywall. The Japanese publisher, who also own The Finanical Times, currently have 800,000 digital subscribers. Through their own subscriber-first strategy, they have been extremely successful in their subscription and retention strategy.

The focus of their subscription strategy is based on 4 pillars:

- Product: Making sure journalism is always Nikkei’s core value.

- Price: Pricing the digital product the same as their print product at $40 a month.

- Place: Build direct traffic.

- Promotion: Developing their own engagement index.

The ability to maintain the same price for digital and print is a clear success for the publisher. Justifying this can often prove challenging but, at the end of the day, subscribers are paying for journalism, key to Nikkei‘s product focus. For Nikkei, this is particularly evident through their fight to build direct traffic.

So what: Defend the value and price of your digital product. Journalism is still at the core.

Innovation in the Netherlands

At the end of 2020, NRC announced that they now had 300,000 paying subscribers. This figure saw a bump of 25,000 digital subscribers over the course of 2020, a spike in a gradual increase of digital subscribers since 2015. With this increase during 2020, 80% of NRC readers now have a digital component included in their subscription. When diving deeper into the numbers, 1.72% (on their way to catching up with the 3.49% of NYT?) of the population of the Netherlands have a subscription to NRC.

Innovation has driven NRC’s success. Not only are they at the forefront of audience relationships, but they are constantly looking at ways to improve their offering. NRC have taken part in the JAMES Launch Partner Programme at Twipe and have unleashed the power of their newsletters as an activation and engagement tool.

Beyond this, NRC have also driven growth through their new audio app. The app is editorially curated daily to provide the best audio for their subscribers. In doing this, consumers are able to listen to podcasts outside of NRC and even outside of Dutch. Their innovation has been key to growth and, as an innovation hub, will continue to be so.

So what: Dare to innovate. Successful subscriber businesses can also be built in smaller markets.

European subscription growth thriving

In Italy, one of the most serious cases of subscriber growth came at Il Corriere della Sera. At the end of December 2020, Il Corriere della Sera reported an 81% increase in digital subscriptions. With this extremely fruitful growth, Il Corriere della Sera ended 2020 with 308,000 digital subscribers. The latest figures signal that this growth is continuing, with subscribers now expected to be around 350,000. With this growth, Il Corriere della Sera has become the biggest subscriber newspaper in Italy.

Looking elsewhere in Europe, Le Monde in France recently announced that they have 400,000 digital subscribers. Over the course of 2020, Le Monde commanded a 25% increase in digital subscribers, growth which has continued. With their daily editions available on Twipe’s Replica Editions solution, Le Monde has become a benchmark in the digital transition. Aiding their growth has been an increasing amount of exclusive editorial content and a large presence on social media.

Social media has been a strategic focus to gain younger users and build a relationship with them where they are. At the time of writing, Le Monde have 1.14 million YouTube subscribers, 398,000 TikTok followers and 1.6 million Snapchat subscribers. The more Le Monde have seen their free audiences grow on these platforms, the higher the level of conversions to paying subscribers they have seen. Currently the number one daily national newspaper in terms of subscribers in France, they have set themselves the ambitious goal of reaching 1 million subscribers by the end of 2025.

So what: Social media may appear to be a minefield, but it has potential for publishers. After all, it is one of the most common places for people to come across news, especially young people. Expose your content and give it a new lease of life.

Other Blog Posts

Stay on top of the game

Join our community of industry leaders. Get insights, best practices, case studies, and access to our events.

"(Required)" indicates required fields